INTRODUCTION

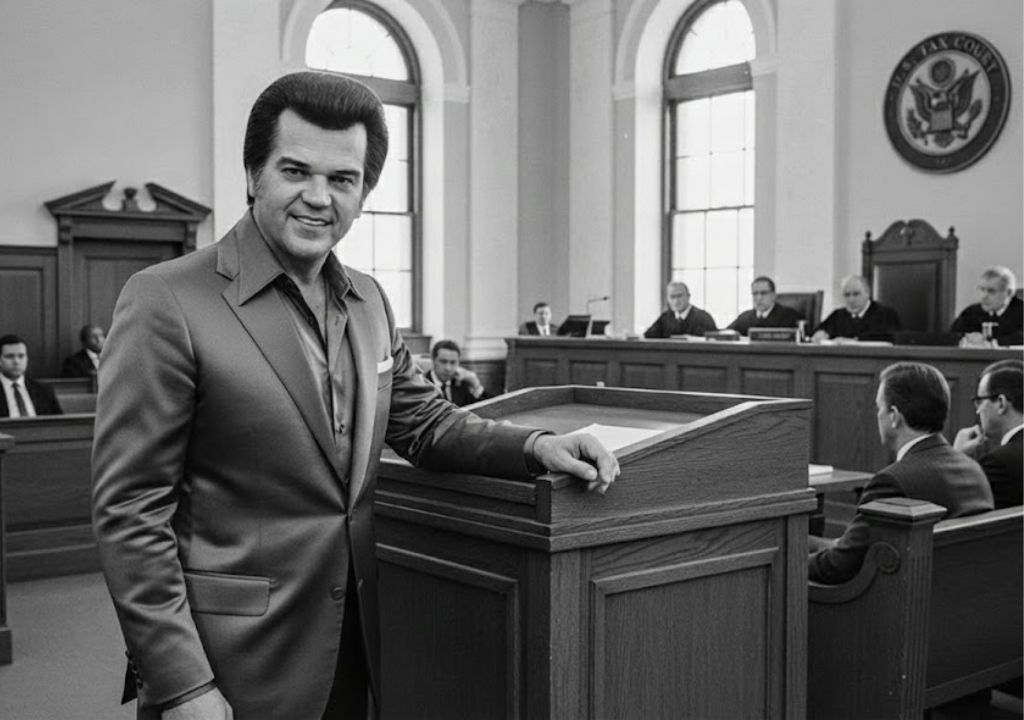

The air inside the United States Tax Court in 1983 carried a weight far heavier than a standard deficiency dispute. At the center of the docket was Harold Jenkins—known to the world as Conway Twitty—challenging the Internal Revenue Service over a $96,000 deduction that the government deemed an act of mere personal “moral obligation.” The conflict began not in a recording studio, but in the grease and neon of “Twitty Burger,” a fast-food venture that had shuttered its doors in 1971, leaving dozens of investors—many of whom were Twitty’s friends and country music peers—with significant losses. For Twitty, the courtroom battle wasn’t just about the $100,000 USD at stake; it was a high-authority defense of the very essence of country stardom: the perceived bond of trust between the artist and his community.

THE DETAILED STORY

The narrative of Jenkins v. Commissioner remains a cornerstone of American tax law because it successfully argued that a “reputation” has a quantifiable, deductible market value. Following the collapse of the Twitty Burger franchise, Conway Twitty made the unprecedented decision to repay his investors out of his own pocket, despite having no legal requirement to do so. When he attempted to deduct these repayments as “ordinary and necessary” business expenses under Section 162 of the Internal Revenue Code, the IRS balked. The Commissioner argued that these were capital expenditures or personal gifts, not business necessities. However, Twitty’s legal team presented a meticulous defense, suggesting that in the nuanced world of country music, an artist’s integrity is their primary capital. Had he allowed his associates to suffer, the resulting “cloud” over his name would have inevitably eroded his concert attendance and record sales.

The court’s decision, rendered on December 22, 1983, was a landmark victory for Twitty. Judge Leo H. Irwin ruled in his favor, acknowledging that protecting one’s business reputation is indeed a legitimate reason for such expenditures. The ruling is most famous among lawyers for its “Ode to Conway Twitty,” a poetic footnote penned by Judge Irwin that summarized the case in verse. The IRS, in a rare display of bureaucratic wit, eventually responded in 1984 with its own “non-acquiescence” poem, acknowledging the loss while maintaining their stance for future cases.

This victory established a paradigm that continues to be cited in 2026. It underscores the reality that for a public figure, the “moral thing to do” can also be a strategic business maneuver. Twitty proved that the cost of maintaining a pristine image is not just a personal burden, but a deductible investment in the longevity of a career. As we look back from 2026, the case serves as a definitive reminder that in the architecture of fame, the foundation is built on more than just talent—it is built on the perceived character of the man behind the microphone.